Ok, my wife says I am really a dork because I got excited when I saw that the 2018 FAA Airman Certificate Data was posted publicly. I told her that I couldn’t be the only person who thought it was fun to look at that data, there had to be at least three or four more people just like me somewhere in the industry. She didn’t disagree that it was probably limited to that few people.

But someone has to look at this data, and with a little contextualization, some of that data can be illustrative of trends in our aviation industry when it comes to the pilot community or our certification trends. The good news, I have been keeping a spreadsheet for this for years, update it with new data, and do it for you! So, with that said, here are a few highlights that I noted after a little data crunching.

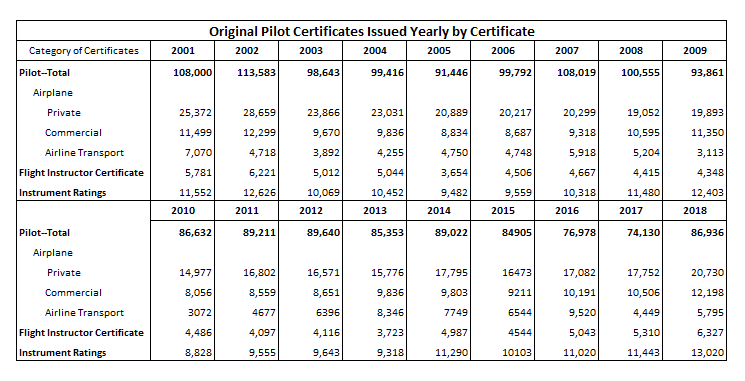

When we look at the overall trend, I find it most broadly applicable to look at a few key metric points. These include overall numbers for things like the Private Pilot, Commercial Pilot, Instrument Rating, ATP Pilot, and CFI Certificates issued on a yearly basis. To help build a baseline for those numbers, the following graphics may be of interest.

I know, the font here is a little small, but I will give you some graphics that help make this a little more understandable for specific considerations.

Let’s start by looking at the big employment question, do we have enough pilots to fly those big airliners the public rides around every year?

ATP Certification Numbers Increasing Again

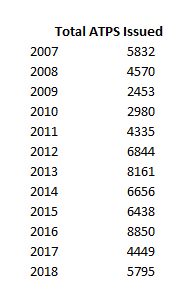

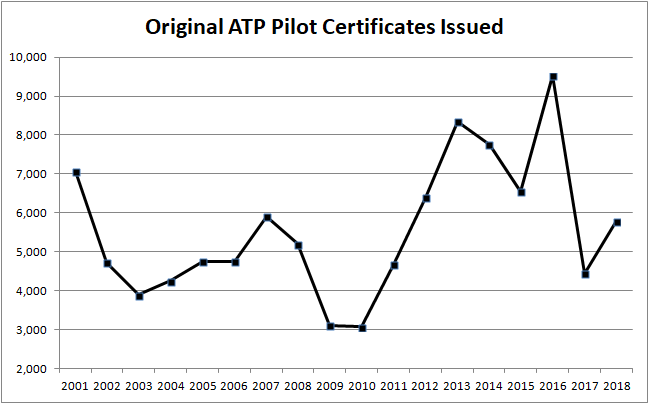

Of critical interest to many of those in the training community, and certainly those hiring for airlines is how our industry is doing at creating new ATP certificated pilots for airline service. After some changes in our certification requirements a few years ago, we saw some fluctuation in our certification process. A major increase as a deadline for new requirements loomed, then a drop off as the structures to train for and test ATP certificated pilots spooled up to again meet our demands. This year showed an increase in this production pipeline again.

We know that much of the increase has been driven by airline hiring and is is strongly supported by the direct provision of ATP CTP training courses and the certification training and testing by airlines provided to their new hires who will then enter service as First Officers at airlines, many of them regional airlines.

This can be seen in the table and graphic data here provided that tracks the ATP certification numbers in the United States, including 2018.

The good news here is that the trend is going back up. For a short period, we were definitely falling behind the demand curve on production of ATP pilots compared to the hiring needs.

But we do still have questions of if this will be enough.

When I compare this to a little data a friend of mine shared with me from just one single major airline, we see that the hiring is going to continue to need to be active for that particular airline in the upcoming year.

We still haven’t hit the worst of the retiring trends due to aging out of pilots. I promise I will come back more to the age question also further down in this article.

When I looked at that particular airlines “count of pilots retiring” between 2019 and 2030 due to being require to retire based on age, it totalled over 6,500 pilots, an average of about 45 pilots per month over that 15 year period! And this is just one airline.

If we extrapolated that across, let’s say, the three major airlines of America, Delta, and United, we could guess that they probably have similar requirements, for a total of 19,500 pilots. If we made an average of 5,500 ATPs per year over that 12 year period, it would mean we added 66,000 ATPs, of which 30% of the ATPs would be needed by just those three airlines. That doesn’t take into account the hiring needs for all of the regional carriers, other big carriers such as Alaska, Allegiant, Frontier, JetBlue, Southwest, any of the cargo carriers, Part 135 carriers, or pretty much every other place ATPs are required to be employed as pilots.

So what’s the gist? Hiring is going to remain active, and even though our numbers are coming back up a little, we may need to increase them significantly to meet the demand even further in the upcoming years.

Another question that remains to be considered for the future will be how Part 135 Certificate holders who provide charter flying service will manage this in absence of internal ATP CTP training courses over the long run. Historically many of these providers have hired already ATP certificated pilots, but as many of these funnel directly into airline operations and the ATP certificate becomes more difficult to obtain without the CTP courses provided at those airlines, the private sector will need to address how to secure the pilots for Part 135 Carriers who are required to be ATPs to serve as captains going forward; either through securing that training commercially, or hiring those already qualified from the airline operational environment.

Private and Commercial Certificates

I told you I would come back to some more base data, but here we go with the base level of certification.

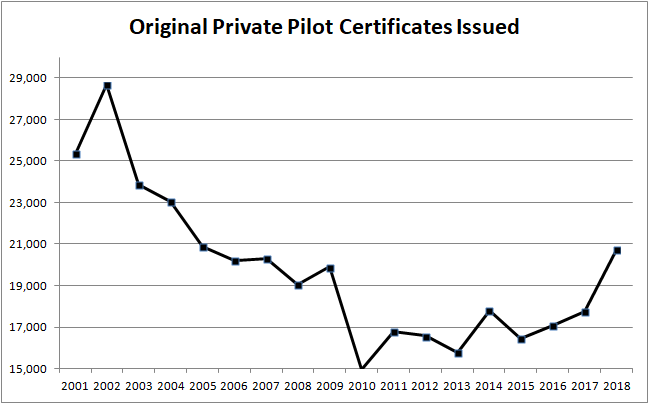

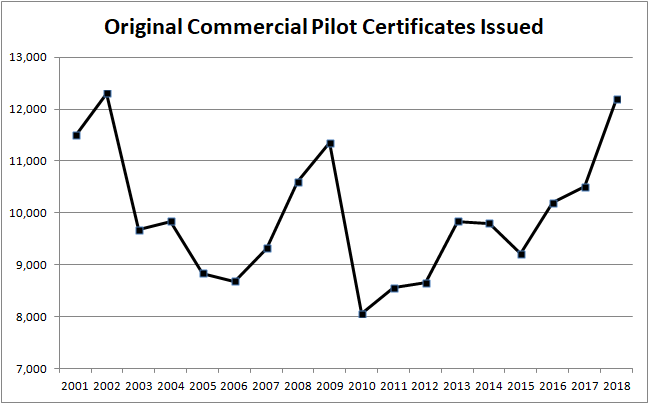

We all know that to get to the ATP level, we need to first get some private and commercial certificates. Extrapolating from the table above, we can see in the following graphs the trends of Private and Commercial original pilot certificates issued.

The trend in Private Pilot (airplane) certificates has certainly dropped off since its high points in an historic consideration, but when we see the trends in the last decade, we are starting to see a trend back upward. What we can’t tell from this data, is if the overall number is down when considering those who are seeking “careers” in aviation and if the overall drop off is representative of just pilots who fly privately, or if it represents those who are seeking to become professional careers. Either way, up is still better than down when it comes to our trends overall.

A little more representative of that basis is the consideration of Commercial Pilot (airplane in this data) certificates. It is more likely that the pilots that get these certificates are seeking to be professionally active in an aviation career. The data also shows a positive trend here in the last decade. Also a good point for our industry.

How about CFIs?

I know I am a little bias when it comes to looking at CFI certificate data as someone who analyzes the pilot production data in our country. So, there is a little more data analysis I have done here.

Why is this important? Well, without CFIs, we can’t make any of the rest of the pilot certificates and ratings happen.

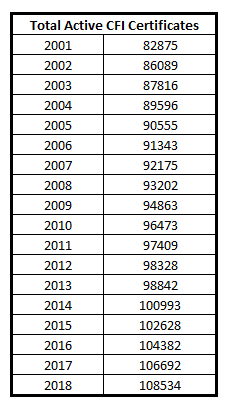

If we look at the total number of CFIs who have active certificates (something they must have earned or renewed within the last two years), we see the overall numbers are actually on the increase. In fact, there are more currently certificated CFIs than anything in recent history.

The table to the right here indicates the total number of CFIs with valid certificates at the end of each year. The overall number of CFIs has continued to grow over the past couple of decades. This includes both those that have CFIs and those that get news CFI certificates each year. But that doesn’t tell the whole story. To get that, we need to look at a couple of other data points also.

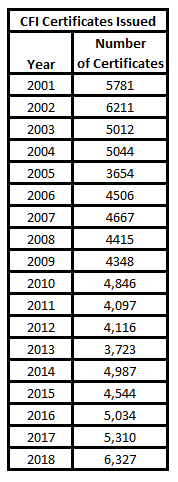

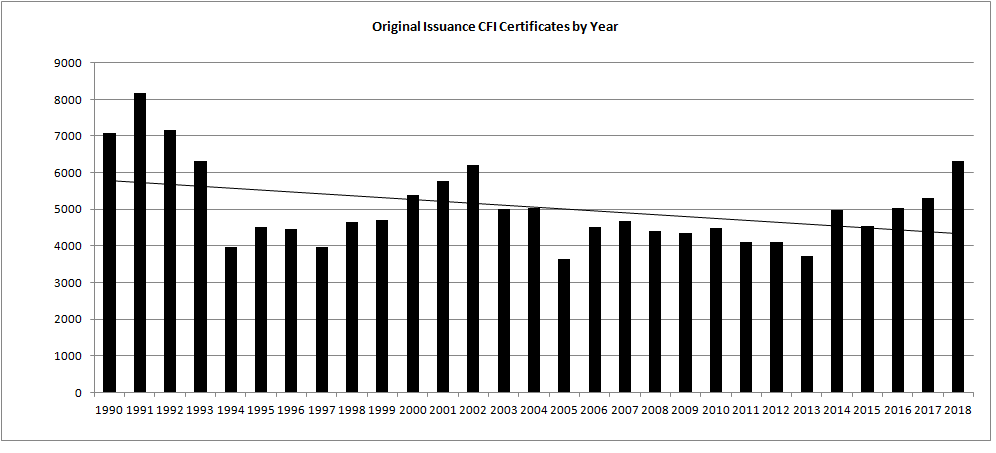

We are also seeing at least a stable, and in some years, slightly increasing, production of the number of new CFIs each year. This is shown in the next table to the right, that shows how many certificates are issued each year over the past years. Interesting, and probably not without some relation to very active hiring of CFIs at airlines, the last year saw the

In most cases, these newly certificated CFIs are the ones that actively engage in CFI work for at least the first couple of years. If they weren’t going to use it at least in the beginning, why get a CFI certificate in the first place, right?

As hiring at airlines became highly active, pilots saw the CFI job as a way to most quickly gain requisite flight hours for employment and have actively pursued CFI certificates to qualify for that work and then move on to airline jobs.

And numbers are great, but when we graph it we can kind of see the trend illustrated in a way that is more visual. Check out the chart below here next.

But are they active?

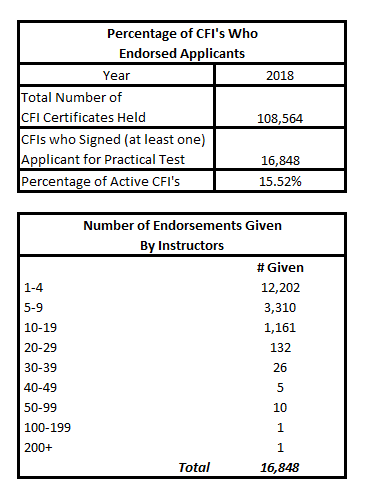

That’s a little tougher question to get to, but with a little specialty data, we can see what percentage of CFIs are actually engaged with the process of endorsing students for practical tests in at least the last year.

When we look a little deeper, we can see that the number of CFIs that actually endorsed an applicant for a practical test, something required to get a rating or certificate, is much lower than the total number of CFIs in our system.

What this data shows us is that, while we may have a large number of CFIs, the overwhelming majority of them are not actually engaged in what we might consider, “the production of the next generation of pilots”. Less than 30% of CFIs based on this data point signed off more than 5 applicants for practical tests in 2018.

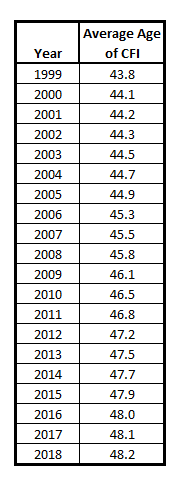

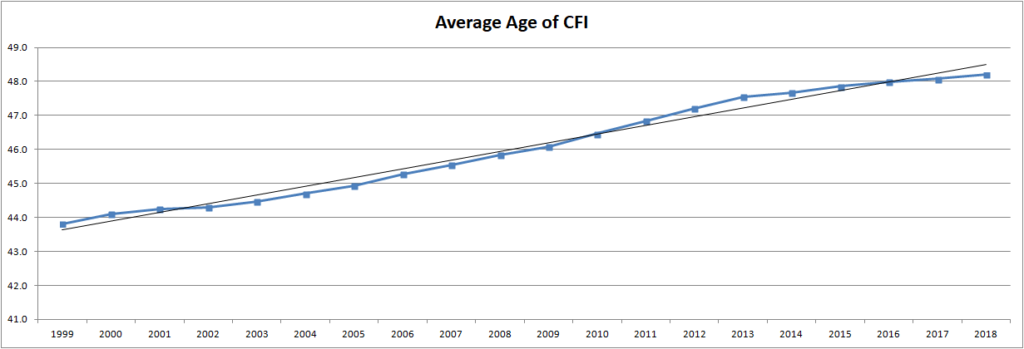

When we consider why this might be the case, one factor to evaluate is the average age of CFIs. It’s getting older.

When we look at the average age of the CFI population, it is trending up fast. You can see this in the table to the right, and in the graph below that shows the trend line since 1999 to this past year, 2018.

But what does this mean?

When we consider what types of CFIs are actively engaged in training the majority of younger pilots seeking careers, it includes typically younger CFIs as an average. Many of the older CFI certificate holders have transitioned to other professional pilot careers and keep their CFI certificates active instead of losing them. As a result, their “day jobs” may not be providing training for applicants seeking ratings and/or certificates, but flying professionally instead. It is a common progression in the pilot career with which we are all familiar. The side effect is that those CFIs are not “active” when it comes to the training environment.

Unlike ATPs, CFIs can work as instructors past the age of 65. But just how long they will do so, or if they will do so actively during their retirement years is a personal choice for many of those individuals. Some do a little instructing for a few years, some do flight reviews and IPCs, and some train their grandchildren or friends. It really is a situational consideration. But what isn’t situational consideration, is that at some point we all retire for good or pass away. When that happens, our CFI certificates become no longer active; renewed.

I expect that much like our ATP pilot numbers, the aging of our CFI ranks means that at some point we are going to see a larger than equally distributed dropoff in our overall number of CFI certificates held. As the average age gets higher, we eventually hit a point where the continued increase of that average is no longer maintainable. Physiology takes a toll eventually.

When that happens, our industry is likely to see an overall dropoff of our CFI numbers and a more traditional stabilization of the number of CFI certificates held in the United States. This effect is just going to take a few more years to see fully as the numbers play out.

So do these points tell us everything we need or want to know?

Nope.

But they do illustrate some data points that can help contribute to our understanding of the pilot certification trends in the United States. If you have made it this far in this article, I sincerely hope you found it useful, maybe even a little bit interesting.