A TSA interim rule has transitioned to a final rule under 14 CFR 1552 that has some changes that are relevant to EVERY CFI who is actively engaged with providing training. One of those items is the requirement as of November 1, 2024 that any CFI providing flight or ground training must have a TSA provider account.

A TSA interim rule has transitioned to a final rule under 14 CFR 1552 that has some changes that are relevant to EVERY CFI who is actively engaged with providing training. One of those items is the requirement as of November 1, 2024 that any CFI providing flight or ground training must have a TSA provider account.

This was historically applicable for training providers who provided training with non-U.S. citizen students, but an account is now required for ALL CFIs, even if they only provide training to U.S. citizens.

The TSA defines a “flight training provider” as:

“(a) Any person that provides instruction under 49 U.S.C. subtitle VII, part A, in the operation of any aircraft or aircraft simulator in the United States or outside the United States, including any pilot school, flight training center, air carrier flight training facility, or individual flight instructor certificated under 14 CFR parts 61, 121, 135, 141, or 142;

(b) Similar persons certificated by foreign aviation authorities recognized by the FAA, who provide flight training services in the United States; and

(c) Any lessor of an aircraft or aircraft simulator for flight training, if the person leasing their equipment is not covered by (a) or (b).

“Flight training provider employee” means an individual who provides services to a flight training provider in return for financial or other compensation, or a volunteer, and who has direct contact with flight training students and candidates. A flight training provider employee may be an instructor, other authorized representative, or independent contractor.”

The new regulation changes indicate that a “flight training provider MUST”:

“Obtain and use an FTSP portal account. (§ 1552.17)”

While the training provided to U.S. citizens still only requires the CFI to:

“Verify a flight training student’s U.S. citizenship before training them, and retain records of these identification verifications for five years. (§ 1552.7),”

It was not previously required that flight training providers who did not engage with providing training to non-U.S. citizens was required to have an account online, it is now. It also requires that individual to be an FAA certificate holder (which is typically not an issue for an independent CFI).

“The FTSP Portal account administrator for providers operating under 14 CFR part 61, either as an individual certified flight instructor (CFI), or for a group of CFIs, must hold an FAA certificate.”

One more highlight for CFIs, previously the TSA security awareness training was required annually, the new regulation is now every 24 calendar months, matching up with CFI currency requirements.

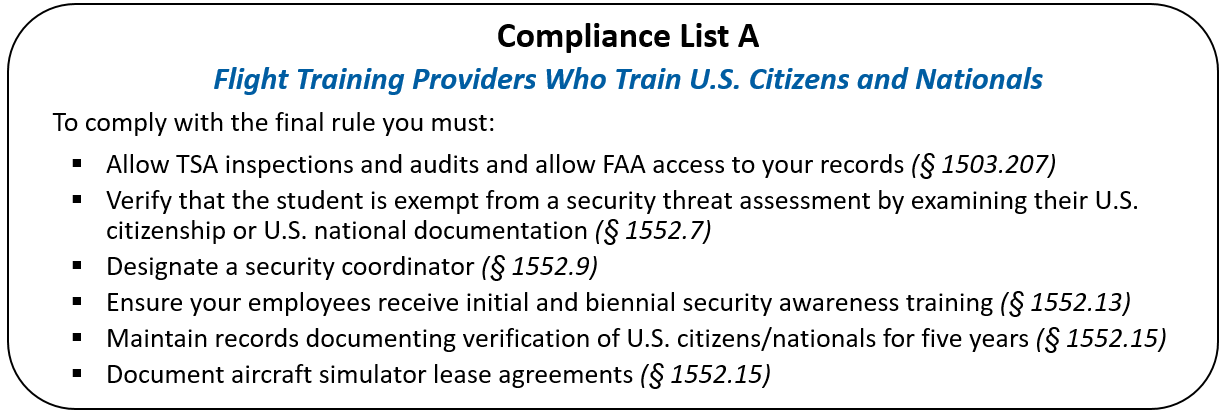

For CFIs who only provide training to U.S. citizens, the flight training provider must:

For most independent and contractor CFIs, the main application portions of this list include having a TSA provider account, validating your U.S. citizen training recipients documentation of citizenship (for 5 years), maintaining your initial and biennial security awareness training, and allowing the TSA to inspect and audit your records if requested.

These TSA Security Threat Assessments (citizenship validation and validation of training allowance for non-U.S. citizens is still required only for the following events:

-

- Initial pilot certification (whether private, recreational, or a sport pilot certificate), which provides a pilot with basic piloting skills.

- Instrument rating, which enhances a pilot’s abilities to pilot an aircraft in bad weather or at night and enables a pilot to better understand the instruments and physiological experiences of flying without reference to visual cues outside the aircraft.

- Multi-engine rating, which provides a pilot with the skill to operate more complex, faster aircraft.

- Type rating, which is a specific certification a pilot obtains to operate a certain type of aircraft, because this training is required beyond the initial, multi-engine, and instrument certification.

- Recurrent training for type rating, which is required to maintain or renew a type rating already held by a pilot.

Other training events such as flight reviews, high performance, tailwheel or complex endorsements, add-on ratings or certificates, and other training outside this list do not require citizenship validation.

The new system (account) does not require documentation of the verification of citizenship for U.S. citizens training in this system. The process and documentation requirements for the CFI have not changed for U.S. citizen training provision.

If you are working for a school or an FBO engaged in training as a more structured school, these requirements may be completed under a Security Coordinator for the school. Be sure either this is the case or engage in doing so for yourself.

———————–

ADDENDUM 10-21-2024:

I have had some questions from people asking if the account is required if you are not actively engaged in training. No is technically the answer here. If you are the holder of a current CFI certificate but not actively providing training, an account is not required until you are doing so.

The purpose of this for the TSA to be able to engage with those CFIs who are actively providing training.

There is an argument that could be made that it is only required for those who are doing the types of training that require citizenship verification.

What I will say, is that it kind of falls into the “why wouldn’t you just have the account” mindset for me.

———————–

This may sound a little confusing, so the TSA has provided a great PDF document summarizing the changes and how these requirements may affect you as a flight training provider or those for whom you provide training.

Click the graphic below to see a pdf document the TSA provided, “Flight Training Security Program – About the Regulation” to see some more details about this requirement and many of the other changes in the regulation process relating to vetting of students who are U.S. citizens and for those who are non-U.S. citizens.

You can register for an account at:

https://www.fts.tsa.dhs.gov/home

Want to see a walkthrough of how building an account goes? Click here or the graphic below for a step-by-step guide to building your TSA training provider account.

You can find the full text of the final rule by clicking here.

Traditional Heading Indicator

Traditional Heading Indicator Horizontal Situation Indicator (HSI)

Horizontal Situation Indicator (HSI)

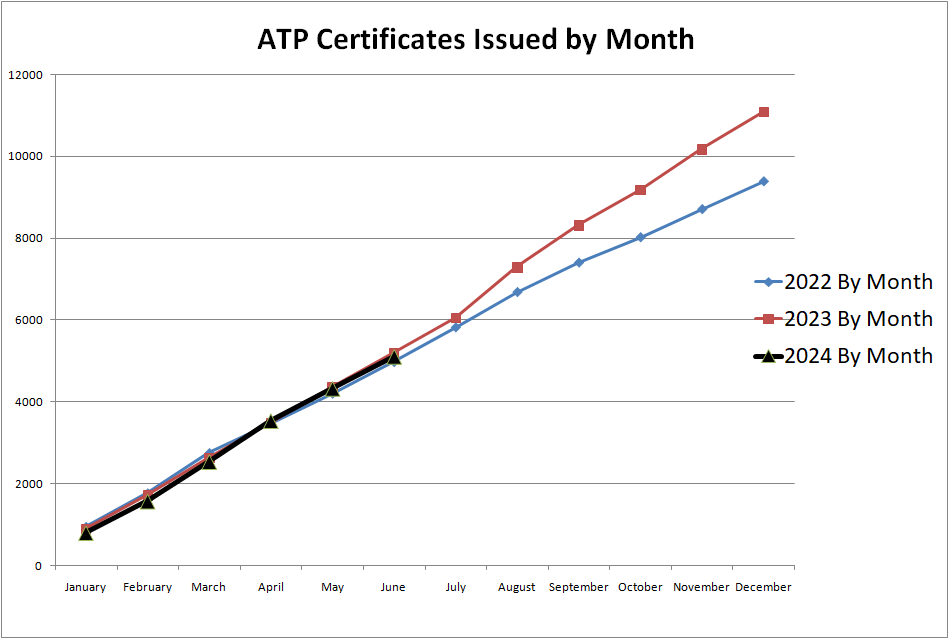

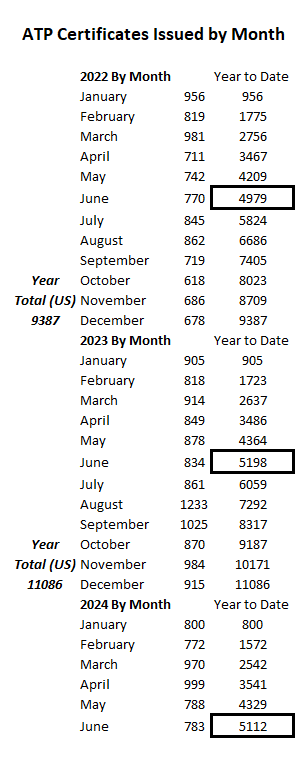

Looking at ATP certification numbers is something that helps us gauge how many pilots we are pushing through the system to go into service in professional, primarily airline, pilot jobs. As we all hear current stories about reductions in hiring, I found it interesting to look at the numbers month-to-month so far this year compared to previous years.

Looking at ATP certification numbers is something that helps us gauge how many pilots we are pushing through the system to go into service in professional, primarily airline, pilot jobs. As we all hear current stories about reductions in hiring, I found it interesting to look at the numbers month-to-month so far this year compared to previous years.