Some concern has been raised over the past year that anecdotal data was pointing to increased failure rates in practical tests. A decrease in applicant performance. Until we got some data, that was all it was, anecdotal. The good news is that we can now put some data analysis to the question in comparison with previous years and see how we are really doing.

The results of that analysis are good and bad.

Commercial and Instrument Pass Rates Stable; Private Drops

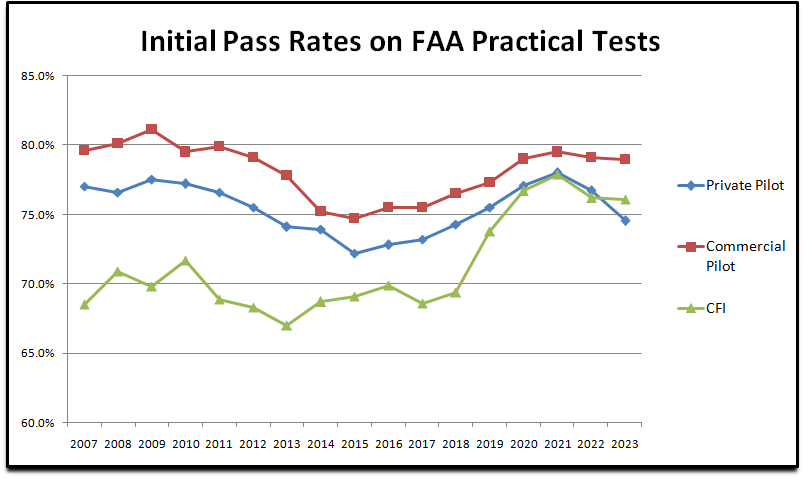

The combined chart here shows us the trending pass rates for primary original issuance certification events in our aviation training system over the past years. We can see that in 2007, 2008, and 2009 we were at a generally higher pass rate than we were in the early 2010s where we saw a little dropoff in each of the certifications. But then we started to improve around 2018.

Pass rates on initial CFI certification actually trended up pretty significantly from the historic rates and private and commercial pilot certification also trended up. Until 2021. We can see the trends in the chart here.

In 2021, we saw a small dropoff in overall pass rate for commercial and CFI practical tests, but a larger dropoff specifically in private pilot certification events. With the 2023 numbers, the commercial and CFI certification pass rates stayed pretty stable, but the private pilot certification rates continued to drop.

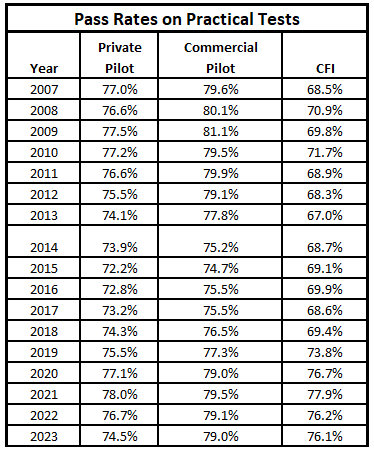

For those of you who want to see the numbers in a little more detail, the chart to the right will help illustrate this point in a more granular manner.

For those of you who want to see the numbers in a little more detail, the chart to the right will help illustrate this point in a more granular manner.

While the private pilot pass rate does not differ significantly from the historic averages, it does show a drop over the past couple of years from a high point pass rate of 78% to last year’s pass rate of 74.5%. No, the world hasn’t stopped spinning and it isn’t going to end over this. But it is an indicator that we are not improving our performance, instead regressing a bit.

Why? I am not sure. But I can’t help but think that the super heavy hiring of 2021 and 2022 left us with a very young active instructor cadre and that experience in training counts for something. The lack of that may be proving out in the performance of their students in their testing activities.

LOTS More Test to Give

Ok, I want to very carefully make this next point. It relates to pass rates, demand for practical tests, and the overall increase in testing volume. While of these items are related, they are not necessarily directly relational or causal. But there are integrations.

We continue to see the demand for more pilot certification increase, and this increases the demand for examiner-conducted certification events. Most of this is done by designated pilot examiners, with a few training providers who are FAA Part 141 certificated operations having self-examing authority. The last time the data was conveyed to me, this only represented about 29 or the 570(ish) 141 training providers, so it isn’t the largest percentage by any means.

When we increase the number of tests demanded, and we have more failures, it means we tax our testing system and those that provide those tests even more.

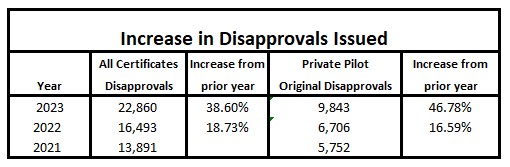

The next chart compares some of this concerning sheer numbers of disapproval issuances by examiners in 2021, 2022, and 2023 overall and specifically for original issuance of private pilot certificates.

We can see that in 2021 examiners were issuing 13891 disapprovals overall, and in 2023 that had increased to 22860. That means that examiners had to conduct at least 9869 additional tests to make up for the disapproval rate. The private pilot disapproval numbers that needed retests increased 46.78% from 2022 to 2023 alone! Ok, this is where I need to be clear also. This is not to indicate that the failure rate went up 46.78%, it is the number of disapprovals that were issued. The failure rate went up 3.5% from 2021 to 2023.

This is probably leaving you asking, well then why did the total disapproval numbers go up that much? The answer is that the overall private pilot certification rate went up significantly also. In 2023 we issued 31950 original issuance private pilot certificates, and in 2022 we issued 24405. That is an increase of overall certification of 7545 more private pilots in 2023 compared with 2022; an increase of 30.9%. This is why I say that the numbers don’t directly correlate. We have a moving total certification number but at the same time a dropping pass rate. The two integrate somewhere in the mix. In either case, one might surmise that pushing through more certifications does not necessarily result in an increase in quality.

Many DPEs I have talked with anecdotally were indicating that they thought here was at least some dropoff in quality, these numbers seem to in part back up that feeling.

Total Test Events Up; DPE Pressure Up

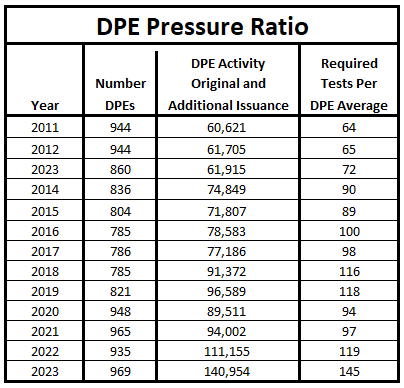

Most in the training environment have indicated continued challenges to source practical tests, with examiners backed up and in high demand. I have been tracking a ratio over the past decade. I have affectionately started personally calling it the DPE Pressure Ratio.

It is a ratio of the number of original and additional issuance approvals and disapprovals issued by examiners for pilot certification.

This chart shows the total number of required activities and the number of DPEs available to serve that need. Averaging this out gives us a required number of tests per DPE average if the tests were spread equally across DPEs in our system.

We can see that our DPE number has gone from 944 to a low point of 785 in 2016 and back up to 969 where we finished off 2023. Considering our certification demand has gone from 60621 to 140954, it has drastically increased the average demand per examiner.

This pressure has been seen throughout our entire aviation system and is, without a doubt, a cause of scheduling backlogs, increased pricing in high-demand markets, and the inability to complete training for some applicants waiting on testing services.

The answer to this demand issue is not a simple one but one that is multi-faceted. A solution probably includes some more DPEs, perhaps fewer part-time and more full-time DPEs, a training system that right sizes itself for the actual availability of testing services, work to decrease failure rates, and potentially alternative testing and certification processes to reduce the pressure.

Unless we are going to reduce the certification demands on our system, this remains a problem that needs address to serve certification testing demands.

I love data & this is very interesting. Thank you for posting! Most of us are very aware of the DPE shortage, but your last table of the DPE Pressure Ratio made my jaw drop. Wow. I wonder how many of these are wasted time when the applicant arrives with incomplete experience, a missing endorsement, unqualified aircraft, or some other paperwork issue. I feel we CFIs need to do a better job of helping our students show up prepared.

Here’s a thought — the initial pass rate for CFIs went up materially in 2019 compared to the previous decade. It’s possible that a good number of these CFI candidates shouldn’t have really passed the first time. Yes, we have ACS/PTS but if there’s any sort of pressure in “the system” to get more CFI’s working, examiners could be compelled to migrate to the outer limits of the discretion envelope. If that happened then the resultant reduction in CFI quality could have also contributed to the lower Private Pilot pass rate.

The result of Covid.