Over many years of flying, there are a few things that I have run into that I keep in my aircraft or hangar that aren’t as common as others, have unique applications, or are just the best version I have found so far to get a job done or be reliable. So, I thought I might share a few of some of these with you in case you might also find them useful.

[Small] Olive Drab Mini Army Style Flashlight

[Small] Olive Drab Mini Army Style Flashlight

A smaller flashlight based on the larger traditional military style flashlight, it comes with multiple color lenses in the bottom that can be screwed in over the beam also. It is only just a little over 6 inches in length, has a full on switch, and has a button that you can use to “push button” on and off for temporary use.

I personally like the blue light lens on it because it doesn’t lose as much color in the cockpit, but it also isn’t as bright as the white.

Click here to find it on Amazon.

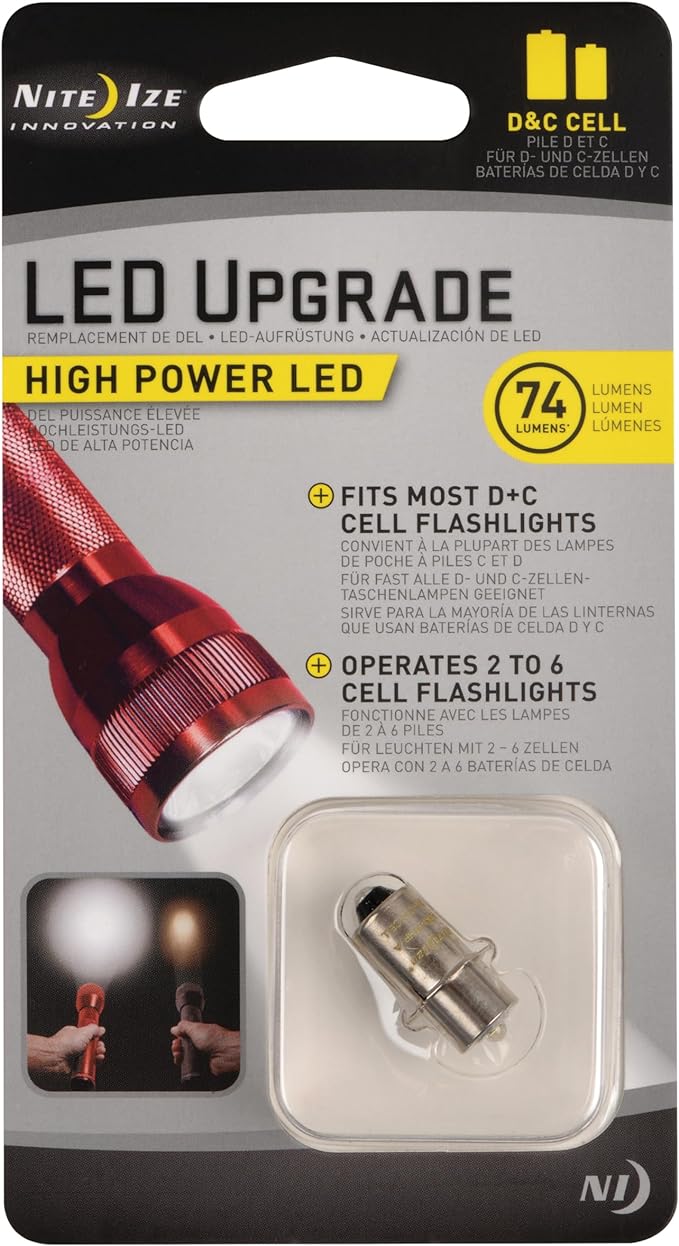

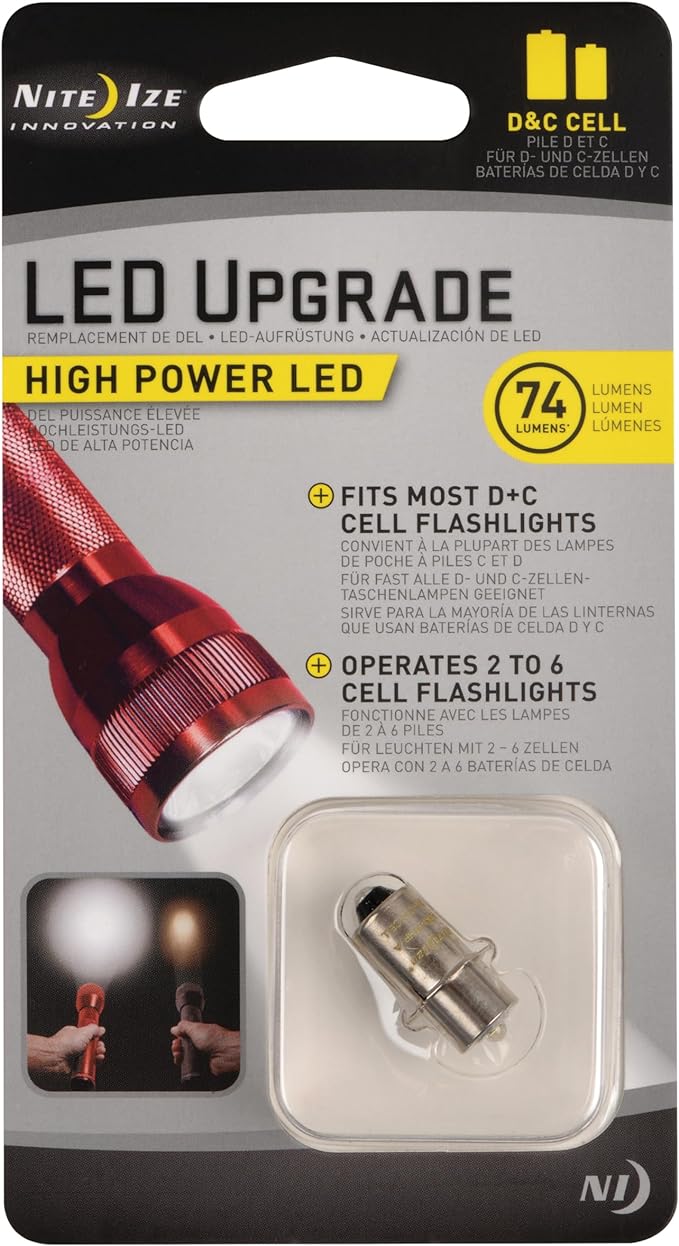

LED Upgrade Bulb for Olive Drab Mini Army Style Flashlight

LED Upgrade Bulb for Olive Drab Mini Army Style Flashlight

I probably wouldn’t do the above flashlight without doing the LED bulb upgrade. They last longer, they don’t break a filament when you drop the flashlight, and they are a good brightness.

It is a quick swap out to change the bulbs and well worth the effort.

Yup, this can also be found by clicking here on Amazon.

TAC-FORCE Spring Assisted Opening EMT EMS ORANGE Rescue Folding Pocket Knife

TAC-FORCE Spring Assisted Opening EMT EMS ORANGE Rescue Folding Pocket Knife

It isn’t expensive, it takes a beating, it has a seatbelt cutter, and its a generally decent knife. Oh, it also has a glass breaker punch on it. it works for one-handed flip out and is a locking blade also.

This is honestly my everyday carry knife that I beat up and don’t care if lose one because it is only $13.80.

I know you are surprised, but you can here to find it on Amazon.

Standard Multi-Bit 15-Piece Ratcheting Screwdriver

Standard Multi-Bit 15-Piece Ratcheting Screwdriver

A basic ratcheting driver set, I keep one of these in my plane for loose screws whenever I find them. The bits fit nicely and hold in securely and there are even a few basic sockets in there also.

I have found use for this pretty basic tool many times, and it even gets through TSA on an airline, so it goes with me when I travel to pick up planes also.

Did you think that you could also click here to find it on Amazon?

Gerber Gear Multi-Plier 600 Needle Nose Pliers Set Bladeless Multi-Tool – 14-in-1 EDC Gear Multi-Tool

Most multi-tools don’t make it through TSA either, but this one [can] if you do it correctly. It will likely take a little explanation and a more detailed look than the baggage scanner, but you can remove the blade on this particular multi-tool.

There are general tools like the pliers, file, scissors, and others, but the thing I remove from this is the blade that is a “RemGrit saw” so it doesn’t actually end up having a blade when I travel. I have used this tool to strip wires, multiple tools with the pliers, and the screwdriver tools too many times to count. It’s another staple in my kit.

Hey, this one is also available by clicking this like to go to Amazon.

Coast HX4 80 Lumen Dual Color (White & Red) Magnetic LED Clip Light with Beam Rotation

Another light I leave in my plane usually is this one. With a rotating head and the ability to make it a red light, it is versatile. But it also has a clip on it.

Another light I leave in my plane usually is this one. With a rotating head and the ability to make it a red light, it is versatile. But it also has a clip on it.

I have clipped it in place when doing a preflight, when working on something, on a hat bill, on a cowling when filling oil, on the panel when wanting to see an instrument with a burnt out bulb, and more. I have also clipped them to a headset band as a forward looking light.

I can’t tell you how long the batteries last, because, I honestly haven’t had to change them in the one of these I have been using for 2 years yet. So, generally, they seem to last.

Good thing, Amazon also has this one. Click here to get it.

Listo 1620 Grease Pencils

A trick a fellow pilot gave me years ago, you can write on a windscreen of an aircraft with a grease pencil and wipe it back off. The upper left corner of my windscreen gets this treatment sometimes with quick notes, frequencies, and clearance information. I keep a couple of these in my flight bag and use them more than I originally thought I would.

A trick a fellow pilot gave me years ago, you can write on a windscreen of an aircraft with a grease pencil and wipe it back off. The upper left corner of my windscreen gets this treatment sometimes with quick notes, frequencies, and clearance information. I keep a couple of these in my flight bag and use them more than I originally thought I would.

Be sure to have a good non-windshield-scractching cloth with you to wipe this off though. They aren’t very big, and they come in packs of 12 how I guy them, so you can afford to lose them once in a while.

Not to be harder to find, these are also available via the services of Amazon.

Rite in the Rain Weatherproof Mechanical Pencil

Another writing tool, but one that is tougher and doesn’t leak ink at all, is a traditional pencil. I like the mechanical one that Rite in the Rain makes that has a durable resing and metal barrel. It is tough. I have dropped it, thrown it to friends, stepped on it, and dragged it around in backpacks and flight bags all over. As long as you have replacement lead for it, it keeps working. It isn’t standard lead you buy with most more engineering-based pencils, it is thicker, so make sure you have the right stuff, but this one is a flight bag staple for me.

Another writing tool, but one that is tougher and doesn’t leak ink at all, is a traditional pencil. I like the mechanical one that Rite in the Rain makes that has a durable resing and metal barrel. It is tough. I have dropped it, thrown it to friends, stepped on it, and dragged it around in backpacks and flight bags all over. As long as you have replacement lead for it, it keeps working. It isn’t standard lead you buy with most more engineering-based pencils, it is thicker, so make sure you have the right stuff, but this one is a flight bag staple for me.

I like the yellow because it is easy to find, but I do think they com in other colors also. The thick lead on this makes it an easy to use in the cockpit writing tool that make thick like and doesn’t break the lead easily. A good notebook for clearances and this pencil go a long way.

Amazon also has this, you can click here to get one (or more).

Flexible Draining Tool Funnel Foldable Oil Drain Flexible Funnel

Not every oil drain, or filter, is in the easiest place to get at without making a mess. A mechanic friend of mine turned me on to these foldable, flexible, oil [or other fluid] funnels. Moldable plastic allows you to make a funnel that can help direct fluids to where it is easier to connect, or even into another funnel or hose that will collect the liquid.

Not every oil drain, or filter, is in the easiest place to get at without making a mess. A mechanic friend of mine turned me on to these foldable, flexible, oil [or other fluid] funnels. Moldable plastic allows you to make a funnel that can help direct fluids to where it is easier to connect, or even into another funnel or hose that will collect the liquid.

In my Stinson, I can fold one of these under the oil drain or the filter and transit the oil to a more manageable collection spot out of the way of many of the other hoses, equipment, and mounts that are otherwise in the way of me not making a mess when I change the oil. I use them on my boat also.

Get yourself a flexible funnel on Amazon by clicking here.

Prist Acrylic and Plastic Windscreen Cleaner

Prist Acrylic and Plastic Windscreen Cleaner

At some point, you will need to clear the windscreen of your aircraft. I honestly also use this stuff to clean bugs off the leading edges of both metal and fabric aircraft. Good no-scratch cloths and this stuff go a long way to seeing outside better and getting the bugs off the leading edges.

Grab a couple cans, and start keeping your plane a little cleaner.

Again, Amazon can help you find this by clicking here.

If you made it to the end of this list and decided to buy everything, you might be wondering how much it might set you back.

At the writing of this, all of this loot would cost you a total of $202.23. Not bad for this many tools. The Gerber tool is the biggest cost at a little over $65, so for under $200.00, you can have a bunch of useful stuff to add to your flight bag or hanger tool chest.

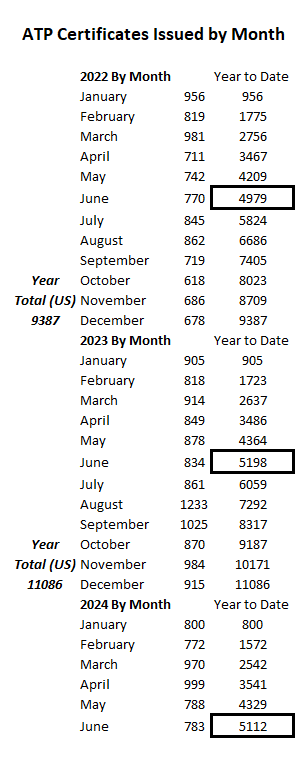

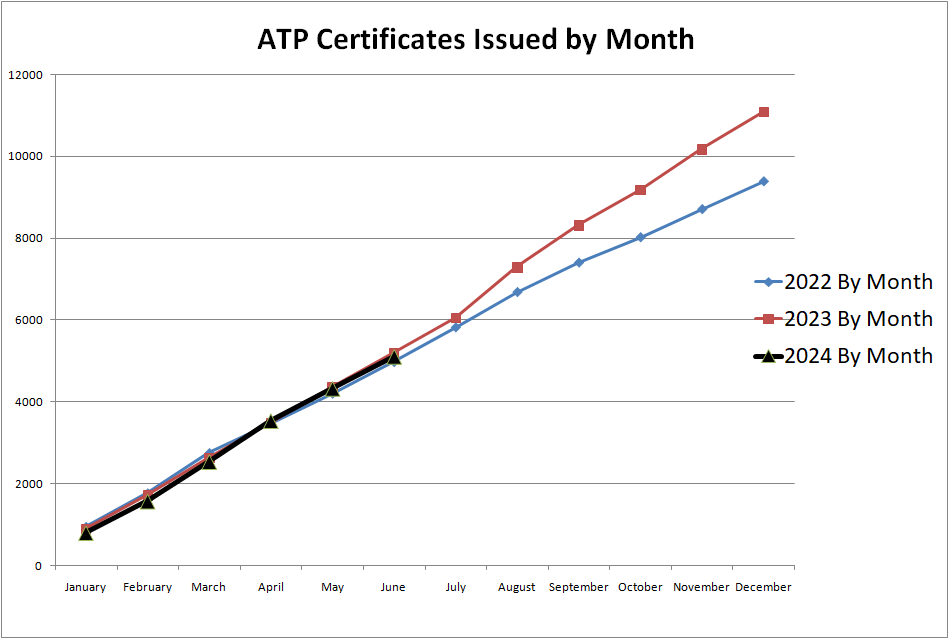

Looking at ATP certification numbers is something that helps us gauge how many pilots we are pushing through the system to go into service in professional, primarily airline, pilot jobs. As we all hear current stories about reductions in hiring, I found it interesting to look at the numbers month-to-month so far this year compared to previous years.

Looking at ATP certification numbers is something that helps us gauge how many pilots we are pushing through the system to go into service in professional, primarily airline, pilot jobs. As we all hear current stories about reductions in hiring, I found it interesting to look at the numbers month-to-month so far this year compared to previous years.

Another writing tool, but one that is tougher and doesn’t leak ink at all, is a traditional pencil. I like the mechanical one that Rite in the Rain makes that has a durable resing and metal barrel. It is tough. I have dropped it, thrown it to friends, stepped on it, and dragged it around in backpacks and flight bags all over. As long as you have replacement lead for it, it keeps working. It isn’t standard lead you buy with most more engineering-based pencils, it is thicker, so make sure you have the right stuff, but this one is a flight bag staple for me.

Another writing tool, but one that is tougher and doesn’t leak ink at all, is a traditional pencil. I like the mechanical one that Rite in the Rain makes that has a durable resing and metal barrel. It is tough. I have dropped it, thrown it to friends, stepped on it, and dragged it around in backpacks and flight bags all over. As long as you have replacement lead for it, it keeps working. It isn’t standard lead you buy with most more engineering-based pencils, it is thicker, so make sure you have the right stuff, but this one is a flight bag staple for me.