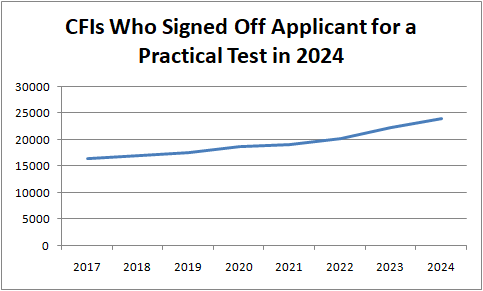

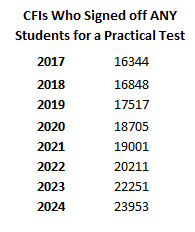

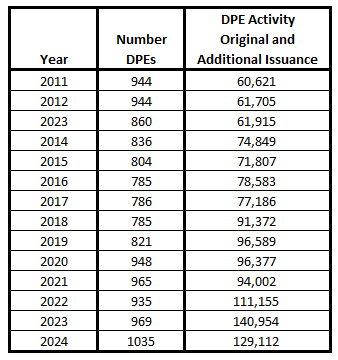

The number of available and how active DPEs are in our U.S. training system.

The good news is that we have seen an increase in total number of available flight qualified DPEs in the last couple of years, with FY2024 ending with the FAA reporting a total of 1035 DPEs in service.

Increasing DPEs numbers helps provide more available testing resources.

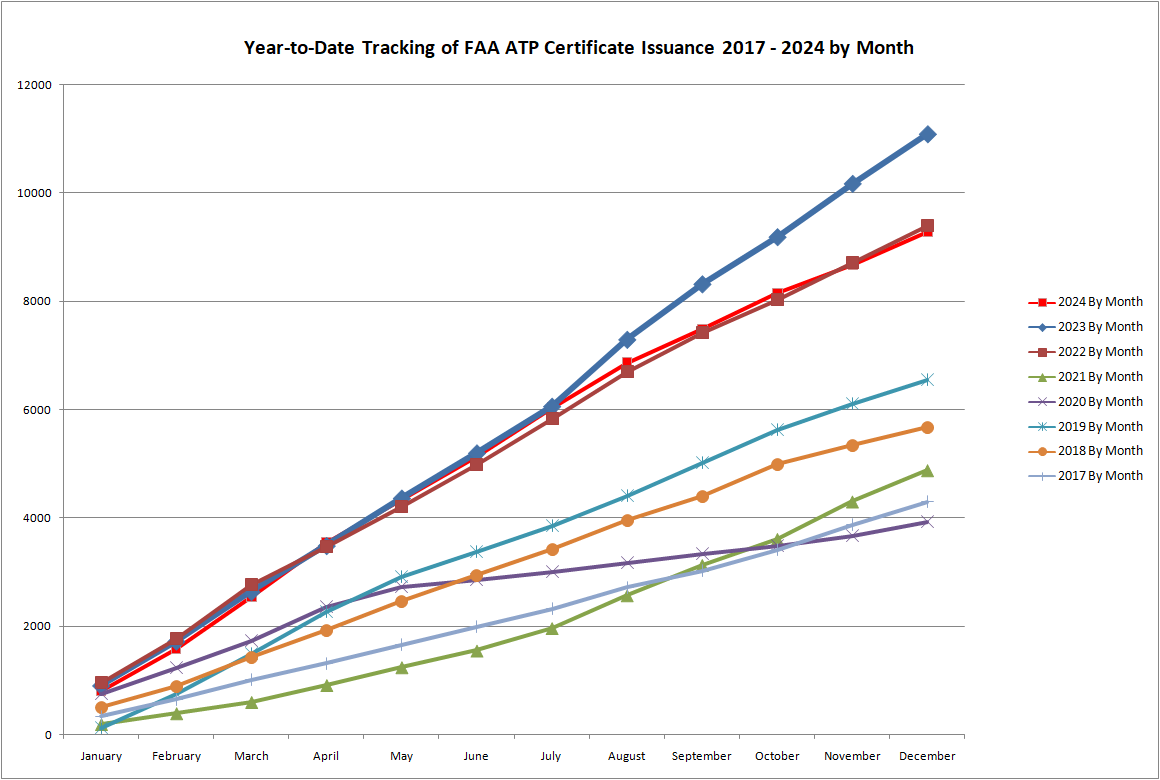

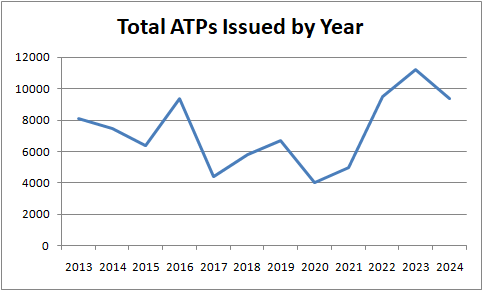

It’s is worth contextualizing the number of available DPEs to the demand for testing additionally. We can see looking back from 2011 where we saw 60,621 tests conducted by the then 944 DPEs that the demand has gone up to the high point in 2023 when DPEs conducted 140,954 practical tests with 969 DPEs. 2024 saw a decrease in testing numbers conducted by DPEs as the DPE overall numbers increased.

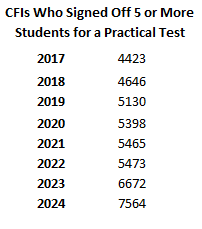

Another key factor to look at is the utilization of the DPEs in our system; how actively they are providing tests. Having a lot of DPEs who don’t do many tests doesn’t help move the volume of tests conducted metric very well.

So, a goal is to have DPEs who are actively engaged in providing greater numbers of tests (within reason).

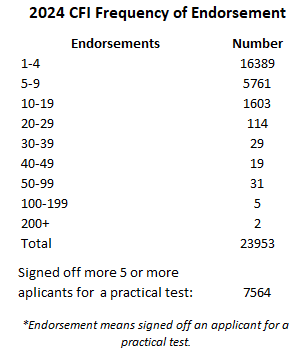

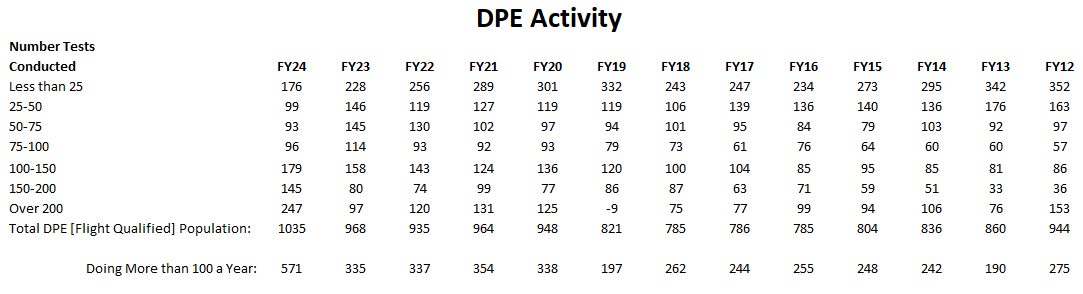

We can see from the chart below that we have improved the number of DPEs actively engaged in providing greater numbers of tests in the last year.

Where we historically saw fewer numbers of DPEs providing testing volumes of over 100, or even 200 per year, in RY2024 we saw both those metrics improve. Back in FY2012 – FY2023 it was common to see smaller numbers of DPEs bearing the burden of larger workloads. As new DPEs are being brought on, it does appear that the workload volume is spreading more across DPEs willing to more actively conduct higher test volumes. This has the potential, if it continues, to help better serve DPE services (practical test) demand going forward.